Use of imported mobile phones in Pakistan requires users to pay a custom duty tax. This means that if you purchased a mobile phone from abroad and brought it to Pakistan, you need to make your device legal for local use. Failing to do so will result in blocking of your device by the authorized state unit i.e. PTA and dump your spent money to waste. If you want to know how to pay custom duty on mobile in Pakistan, we have got you covered with all the important details.

For those who do not know, Pakistan Telecommunication Authority (PTA) launched an online system to cater to illegal usage of mobile phones in Pakistan. The Device Identification, Registration and Blocking System or DIRBS keeps a track of imported mobile devices with their legal or illegal status. With the help of the DIRBS, users can easily pay the custom duty tax on mobile devices without having to go anywhere. We will show you how to pay your custom duty on mobile in Pakistan. But first, you need to check the registration status of your mobile device with PTA. Here’s how you can do it.

How to Check Mobile Device Status with PTA?

To check your mobile device status with PTA, you simply need to send your mobile’s IMEI number to 8484. Once done, you will receive a reply showing the registration status of your device with PTA. If your device is compliant with PTA, you don’t have to pay any tax for it. However, if your device is not compliant, you will have to pay the tax to register it with PTA and use it legally.

Checking your IMEI status is important for several reasons. More often than not, mobile users in Pakistan tend to purchase mobile devices from local sellers. Keeping in view the local market scenario, you may need to check first if the device you purchased is registered with PTA or not.

Note: If you would like to learn more, our mobile registration with PTA guide can help you.

Now, lets have a look at the instructions on how to pay custom duty tax on mobile devices.

How to Pay Custom Duty on Mobile?

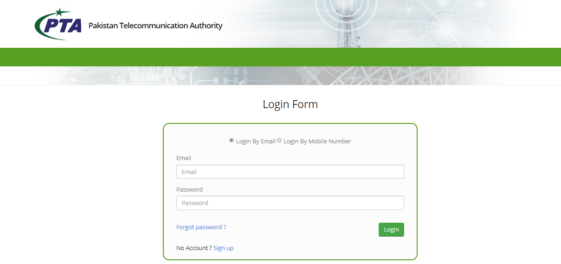

- To pay custom duty on mobile in Pakistan, you first need to access this link (https://dirbs.pta.gov.pk/drs/auth/login).

- Once you open the link, click on Sign up.

- In the next step, you will find an important notice for individuals. Make sure to read all the instructions carefully as stated in the notice.

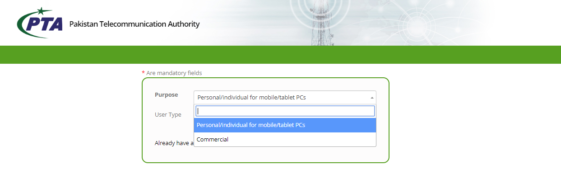

- After the notice with instructions, you will see two mandatory fields, ‘purpose’ and ‘user type.’

- Once you click on purpose, you will see two options “personal” and “commercial”.

Note: The commercial option is only for the importers or companies registered with FBR.

- Select the “personal” option and also choose the user type.

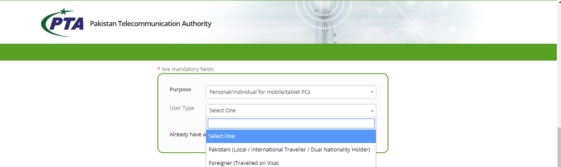

- Now you will find two options, ‘Pakistani’ (local, international traveller, dual nationality case) and ‘Foreigner’. Click on the option valid in your case.

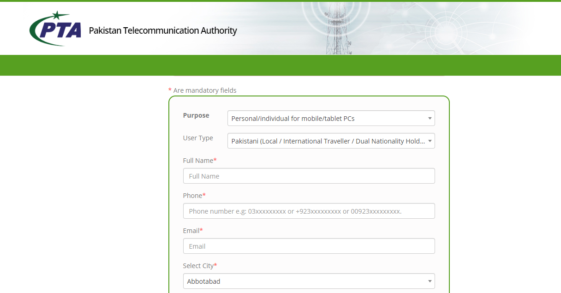

- After that, you have to fill out the form and provide all the details such as your full name, email address, phone number etc.

- Once you enter the required information, click on “Submit”.

- You will receive a confirmation email by PTA on your given email address.

- After account confirmation, you have to type your email address and password to log in.

- Once you log in to your account, you will see the individual COC option on the left side of your screen. Click on it.

- Now click on Apply for COC.

- Once you click on it, you will see multiple options on your screen.

- Select the best suitable option indicating whether you are a local or an international traveller, or if you received the mobile phone through a courier service.

- Let’s assume that you choose the local option. Now you just need to select your network operator and write your contact number.

- Once done, select the number of slots of your device.

- After selecting mobile slots, you have to write the IMEI number of your device. If you have more than one slot, than you have to write IMEI’s for all of them.

- Once you’re done with entering the IMEI, click on “submit”.

- Upon verification of the details, the system will automatically generate the Payment Slip ID (PSID) code along with duties and taxes.

- You can use the PSID code and pay the tax through online banking, mobile wallets, ATM or in the branch of all the major banks including National Bank of Pakistan (NBP), Muslim Commercial Bank (MCB), Allied Bank Limited (ABL) etc.

Important Notice

Once you receive the PSID, please remember that the generated PSID is only valid for seven days. Failing to make the payment in this time, you will have to apply again for registration process.

How to Pay Custom Duty on Imported Mobile via Online Banking?

As also mentioned above in the instructions, you can pay your custom duty on mobile in Pakistan online through any bank service. However, we have listed down instructions below to help you pay through HBL or MCB bank easily.

Pay Via HBL Online

- Login HBLi (HBL Internet Banking)

- Click on the option ‘Pay’

- Click on ‘+ Make New Payment’

- Select category as ‘Govt/ Excise/ Taxation’

- Select ‘FBR’

- Enter the 17 digit PSID (given by PTA/ FBR) in the text box

- See the payment details and click ‘Next’

- Enter One Time Password (sent to your mobile number and email by HBL) and click ‘Pay’

- Congratulations you have paid the taxes successfully.

Pay Via MCB Online

- Login to MCB Internet Banking

- Click on ‘Bill Payment’ option and then select ‘Register Biller’ and ‘Add New Biller’.

- Select ‘FBR’ as the biller

- Enter PSID number and confirm payment on the next screen.

Import Duty Rates for Mobile Devices

If you are wondering what are the import duties on different mobile devices, the devices are divided into a total of 6 slabs depending upon their prices.

1- Up to $30 – Rs300

2- Above $30 and up to $100 – Rs2,940

3- Above $100 and up to $200 – Rs4,510

4- Above $200 and up to $350 – Rs6,180

5- Above $350 and up to $500 – Rs17,650

6- Above $500 – Rs31,520