In Pakistan, more than 50% of the population consists of youth and in a bid to cater their need for self-employment, the incumbent federal government led by Pakistan Muslim League-Nawaz (PML-N) initiated a brilliant Loan Scheme in January 2023 (#BatNhiSrfKam).

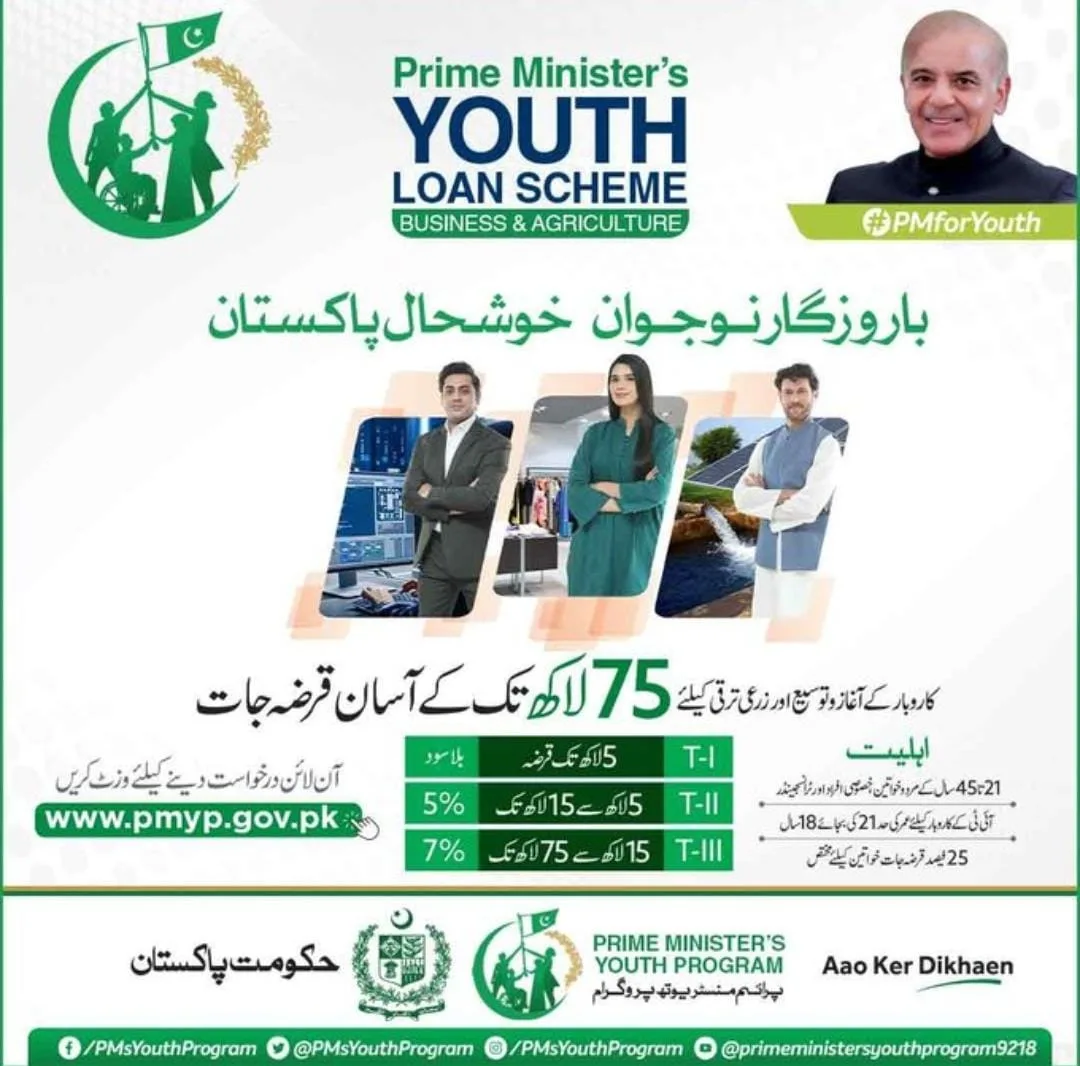

The Prime Minister’s Youth Business & Agriculture Loan Scheme aims to provide the youth with the basic infrastructure to kick start their journey of business owners.

Who Can Apply for Youth Business & Agriculture Loan Scheme?

Who Can Apply for Youth Business & Agriculture Loan Scheme?

- Resident Pakistanis

- 21-45 years of age

- Minimum age limit 18 years for loans for IT/E-Commerce related businesses

- Non-government employees

- Both males & females (25% quota reserved for women)

- No minimum educational qualification

What Prime Minister’s Youth Business & Agriculture Loan Scheme Offers to Youth?

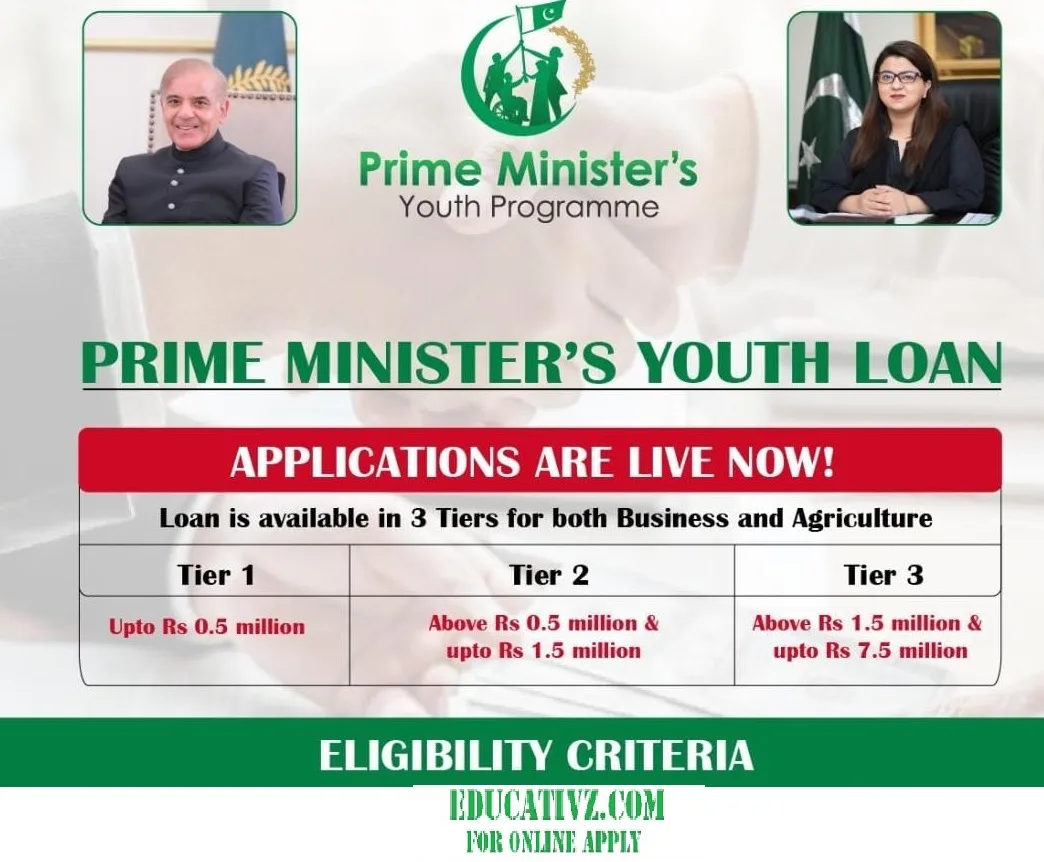

Under the Scheme, soft loans from Rs 500,000 to Rs 7.5 million are being given to the youth.

The youth can avail an interest free loan of up to Rs 500,000 which can be paid back in 3 years while the loans from Rs 0.5 million to Rs 1.5 million are being given at the interest rate of just 5% that can be returned in 7 years.

An interest rate of 7% will be charged on loans ranging from Rs 1.5 million to Rs 7.5 million and the amount can be returned in 8 years.

The Loan Scheme has been segregated into 3 following tiers:

The Loan Scheme has been segregated into 3 following tiers:

-

Tier 1

The range is Rs 0.5 million with 0% markup

-

Tier 2

The range is above Rs 0.5 million upto Rs 1.5 million with 5% markup

-

Tier 3

The range is above Rs 1.5 million upto Rs 7.5 million with 7% markup

How to Apply for the Loan Scheme?

- The aspirants need to submit their applications online at the following link;

https://pmyp.gov.pk/bankform/newapplicantform

- Fill the form by entering;

- CNIC

- CNIC Issue Date

- Select the Tier Loan Option

- Press the “Enter” Button

How to Check the Status of the Loan Application?

- Click here to check the application status

- Fill the form by entering;

- Applicant’s CNIC

- Mobile No

- CNIC Issue Date

- Date of Birth

- Press the “Submit” Button