Pay Your Vehicles Token Tax Online

Government of Pakistan has digitalized the system in different departments to facilitate citizens in the best possible ways. In this fast-moving era when everything is in a competition of up-gradation all over the world, it is important for the Govt. of Pakistan to meet the targets set by different developed countries in terms of digitalization. So the god news it that you can pay your car token tax online now.

PITB’s e-Payment for Token Tax Collection

Punjab government collects revenue of approximately Rs. 300 billion annually in taxes and levies. In order to streamline tax and levies collection process for citizens, PITB has planned an e-Payment Gateway that will remove the need for physical visits and wait in long queues.

Citizens will be able to conduct these transactions through a smartphone application anytime, anywhere. This app is not limited to online payments but has several other P2G services like launching municipal complaints and applying for police character certificate and for domiciles, etc.

In order to execute financial transactions, the PITB is working with banks to design a seamless model and architecture of the gateway application.

How to Pay Vehicles Token Online?

Now you can pay token tax for the vehicles online without any hassle of standing in long queues and wasting your time. Here is how you can proceed with online payment of token tax:

- Install the application from play store (Android) or app store (apple)

- The next step is to create an account

- Then you have to select excise and taxation

- Search for vehicle (basically, it asks for the registration plate number)

- Then the application will generate challan

- The last step is to note the PISD number and make the payment

Functions of e-Payment

This application shall accommodate the following government functions:

- e-Stamping

- e-Challaning

- Vehicle Token Tax

- New Vehicle Registration

- Vehicle Ownership Transfer

- Property Tax

- Professional Tax

- Entertainment Tax

- Driving License Fee

- Domicile Fee

- Character Certificate

- Municipal Complaints

- Police Complaints

Motor Vehicle Tax

Motor Vehicles Tax is an important levy of Excise & Taxation Department. It brings considerable revenue and is another major source of income to the exchequer. It is administered under the provisions of the Motor Vehicle Ordinance, 1965 and Motor Vehicle Tax Act, 1958.

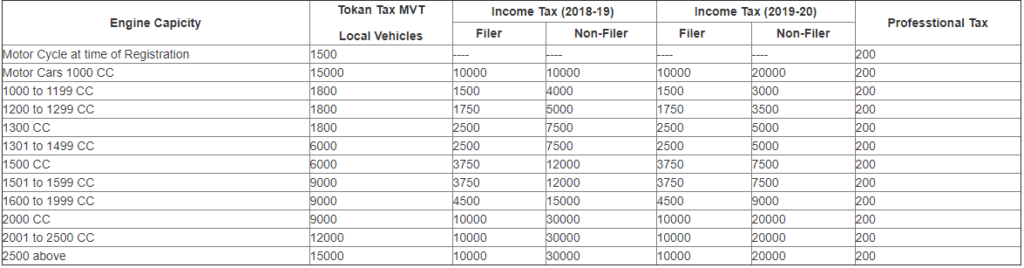

Rates of Token tax for Motor Car

Here is the rates list of token tax, Income Tax and Professional Tax for Motor Car:

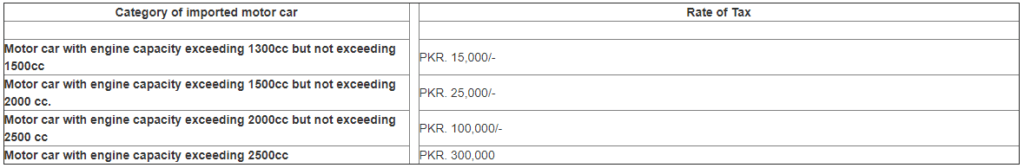

Rates of Token Tax for Imported Cars

Here is the list of token tax for imported cars:

Terms & Conditions

- The Government may, by notification, exempt any class of vehicles from the levy of the tax under this section

- The tax under this section shall not be levied on a motor car owned by the Federal Government, the Government or any other Provincial Government

- The Government may by notification in official Gazette, make rules to carry out purposes of this section