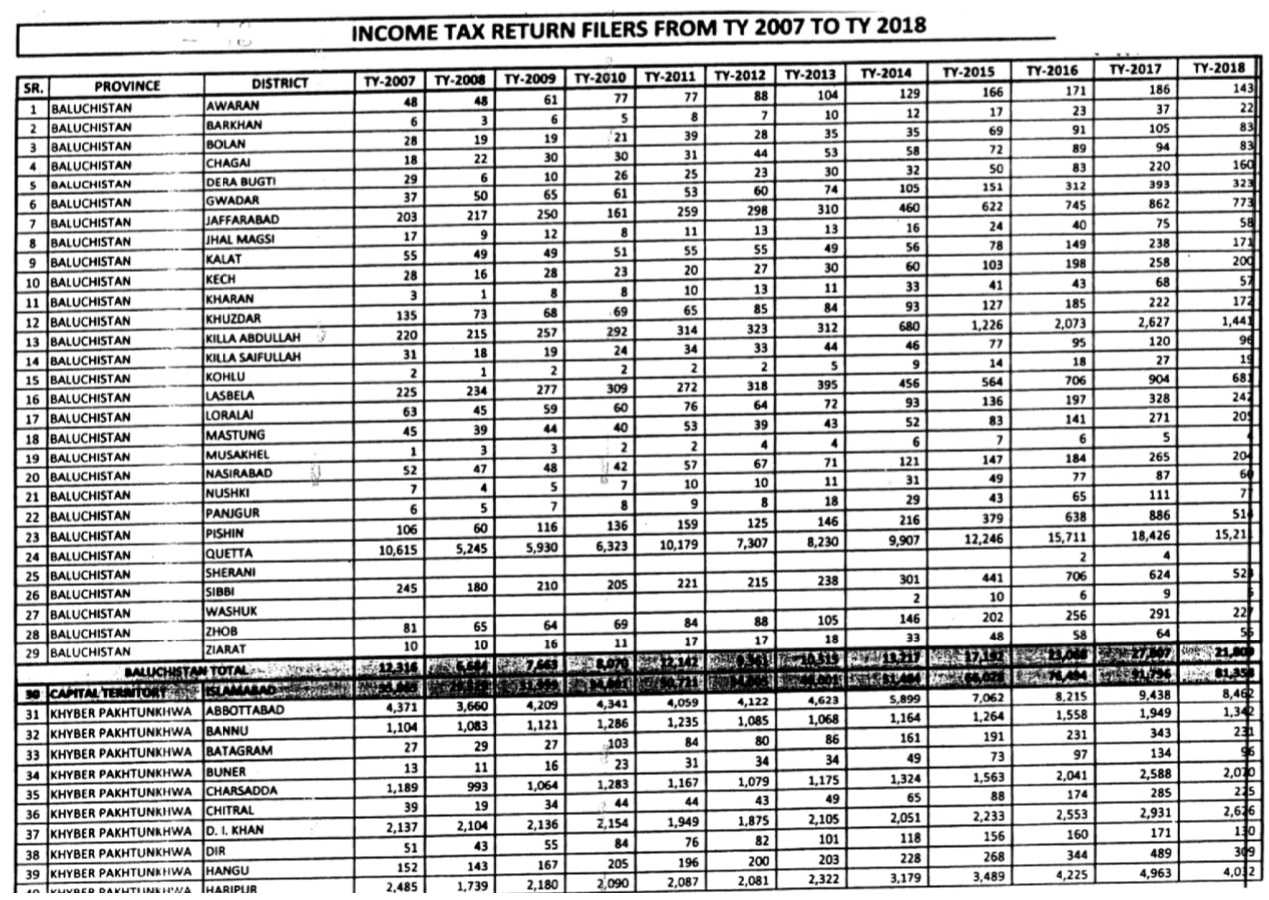

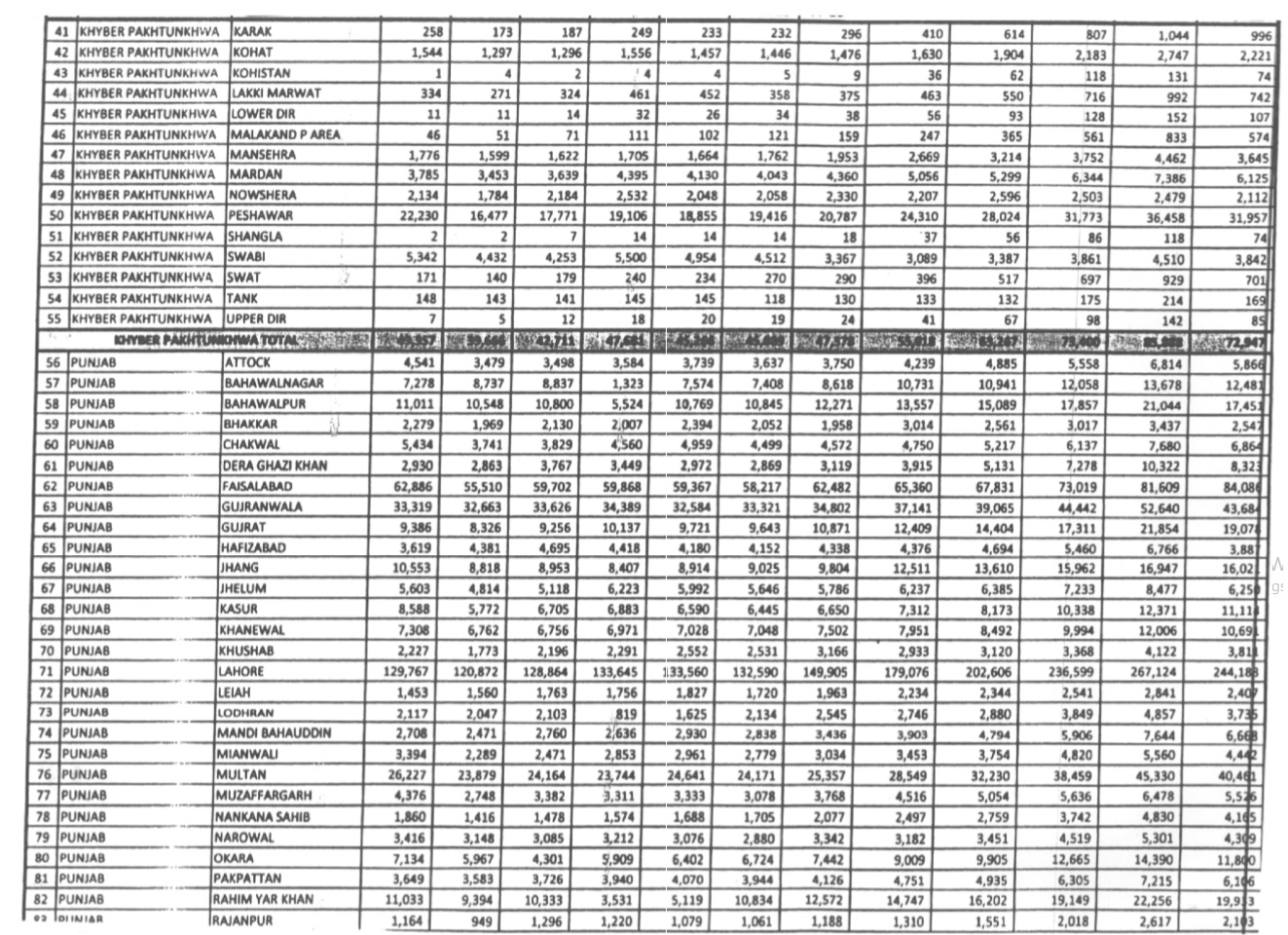

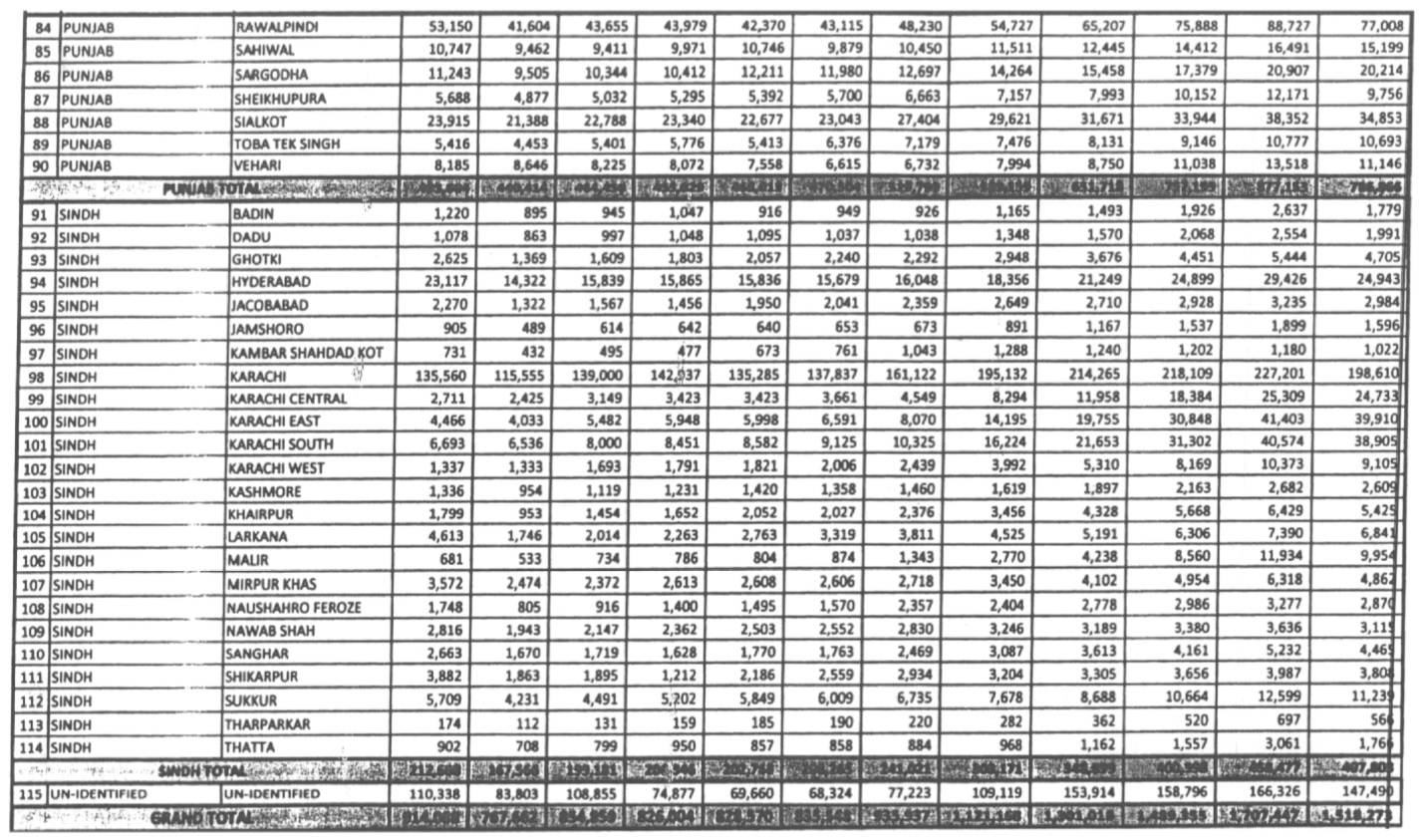

Number of income tax return filers in the Country from 2007 to 2018 with year, province and district wise breakup;

Income Tax Return Filers in 2018

- Karachi: 322,363 people filed their income tax returns

- Lahore: 244,188 people filed their income tax returns

- Quetta: 15,211 people filed their income tax returns

- Peshawar: 31,957 people filed their income tax returns

- Abbottabad: 8,464 people filed their income tax returns

Steps being taken by PTI government to increase tax base in the Country;

The Federal Board of Revenue (FBR) has developed following innovative strategy to increase the tax base:

- Mapping Big Businesses & Services (MBBS)

The FBR would focus on four big & flourishing businesses:—

- Private Hospitals/ Diagnostics/ Labs/ pharmacies

- Eateries & Food outlets/ Bakers/ Wedding Halls

- Entertainment sector, Event Management concerns, professionals linked with showbiz, sports, Drama, film, music and theatre. Amusement parks & facilities Private Educational Institutions, especially joint ventures with International universities.

- Focusing Real Estate Sector

- The real estate sector witnesses countless transactions each year, (mostly falling outside formal tax regime) is infested with concealment, gross understatement and duplicate documentation. The FBR intends to gather investors’ data, identify unregistered persons and ensure that due tax is paid by them.

- Usage of Technology

In order to augment above efforts, following measures will be taken:

- Development of a mobile app to file online return with greater convenience is under consideration.

- Integration of databases like NADRA, Provincial Revenue Authorities, Excise & Taxation Departments, Utility Companies and Land Registering Authorities with that of the FBR. This will be done in a way that a 360 degree view of economic profile of a taxpayer/non taxpayer is developed.

- Multilateral / Bilateral Conventions

- Pakistan has signed the Multilateral Convention on Mutual Administrative Assistance in Tax Matters (the Multilateral Convention) alongwith 126 other countries enabling Pakistan to obtain financial data of Pakistani national in the following three ways:-

- Exchange of Information on Request

- Spontaneous Exchange of Information

- Automatic Exchange of Information

- Moreover, Pakistan has signed 65 Avoidance of Double Taxation Agreements with other countries. Under theses bilateral arrangements information may be exchanged with treaty partners on bilateral basis.

- Pakistan has also signed Multilateral Competent Authority Agreement (MCAA). FBR has successfully exchanged information with 39 jurisdictions in September, 2018. The number of exchange partners is likely to increase in 2019 and onwards.

- Any information exchanged with any partner jurisdiction under any of the above frameworks can be used for the purposes of broadening of the tax base.

Note: The above data & info was provided to the Senate by the Minister for Finance, Revenue and Economic Affairs.