Interbank Exchange Rates in Pakistan

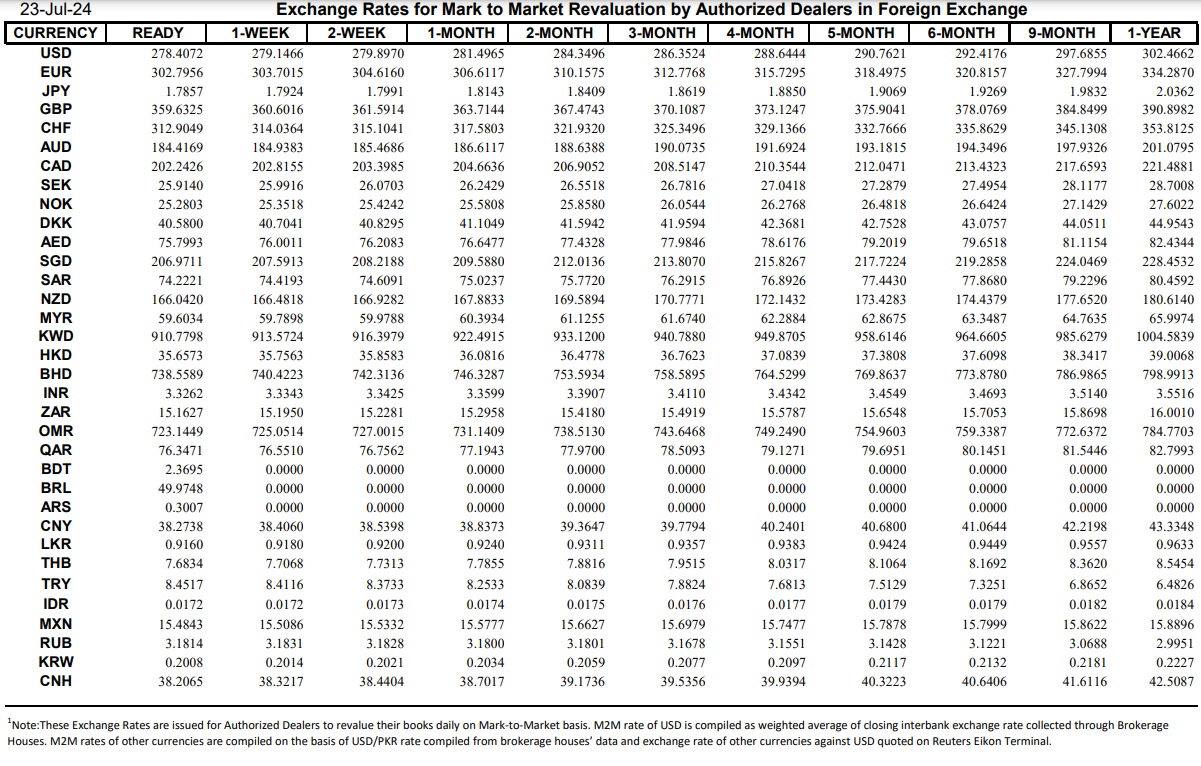

The Interbank Closing Exchange Rate in Pakistan has been issued by the State Bank of Pakistan (SBP) for July 23, 2024.

Interbank Dollar Rate Today in Pakistan – 23 July 2024

At the Closing of the Trading Session in the Interbank Market on July 23, 2024, the US Dollar (USD) settled at 278.40 against the Pakistani Rupee (PKR), appreciating by 0.03 percent.

#PKR depreciates by 0.11 rupees or 0.04% against #USD to settle at 278.41 in today’s interbank session.

MTD: -0.07 rupees or -0.02%

FYTD: -0.07 rupees or -0.02%

CYTD: 3.45 rupees or 1.24% pic.twitter.com/8AxyiW79pV— Mettis Global (@MettisGlobal) July 23, 2024

The Euro (EUR) stood at Rs 302.79, the British Pound (GBP) at Rs 359.63, the Canadian Dollar (CAD) at Rs 202.24, the Australian Dollar (AUD) at Rs 184.41, the UAE Dirham (AED) at Rs 75.79, the Saudi Riyal (SAR) at Rs 74.22, the Chinese Yuan (CNY) at Rs 38.27, and the Turkish Lira (TRY) at Rs 8.45.

Exchange Rates against Pakistani Rupees Today

- USD to PKR – USD/PKR (1 US Dollar equals 278.40 Pakistani Rupees)

- EUR to PKR – EUR/PKR (1 Euro equals 302.79 Pakistani Rupees)

- GBP to PKR – GBP/PKR (1 British Pound equals 359.63 Pakistani Rupees)

- CAD to PKR – CAD/PKR (1 Canadian Dollar equals 202.24 Pakistani Rupees)

- AUD to PKR – AUD/PKR (1 Australian Dollar equals 184.41 Pakistani Rupees)

- AED to PKR – AED/PKR (1 UAE Dirham equals 75.79 Pakistani Rupees)

- SAR to PKR – SAR/PKR (1 Saudi Riyal equals 74.22 Pakistani Rupees)

- CNY to PKR – CNY/PKR (1 Chinese Yuan equals 38.27 Pakistani Rupees)

- TRY to PKR- TRY/PKR (1 Turkish Lira equals 8.45 Pakistani Rupees)

Interbank Exchange Rate in Pakistan Today

Currency |

Exchange Rate (In PKR) |

| USD | 278.40 |

| EUR | 302.79 |

| GBP | 359.63 |

| CAD | 202.24 |

| AUD | 184.41 |

| AED | 75.79 |

| SAR | 74.22 |

| CNY | 38.27 |

| TRY | 8.45 |

Also Read: Pakistan’s foreign reserves stand at $14.7 billion

It’s worth noting that like elsewhere around the Pakistan, exchange rates are not fixed in Pakistan as well and they can fluctuate everyday due to a variety of factors including market forces, interest rates, inflation, political & economic stability, and speculation.